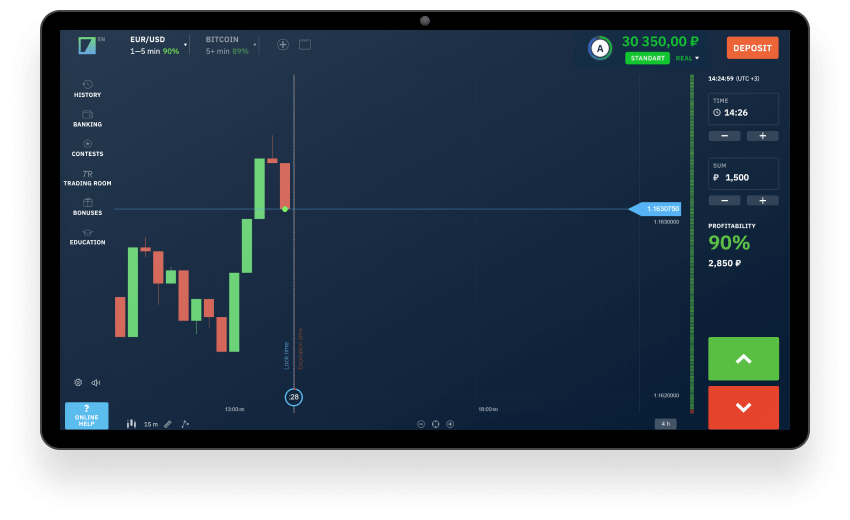

To trade forex on margin on the IQ Option platform, follow these steps:

1. Open a new asset and select "Forex".

2. Enter a trade size by clicking the "Quantity" button.

3. Set optional parameters if you wish:

- If you would like to open a position with the expiration time, press the "Expiration" button.

- Set the take-profit/stop-loss levels.

5. Make your forecast and open a trade.

6. Close your trade manually in the "Portfolio" or wait until it closes automatically in case you set optional parameters.

Please note that your trade will be forcibly closed in case your margin level falls below 50%.